Unlock the full potential of your claims data with real-time, AI-driven intelligence

Turn historical claims data into actionable insights that improve underwriting, pricing, and risk forecasting.

Gain deeper portfolio intelligence with advanced cause-of-loss analytics.

What is Sofix?

Designed for the London Market. Built for the Future. AI-powered claims automation and analytics tailored to the complexity of specialised insurance.

AI-driven

FNOL

Instant claims intake with no manual steps

Cause code

analytics

Leverage cause code analytics to drive strategic alignment between underwriting and claims

Connected

ecosystem

Fully integrated with the London market infrastructure

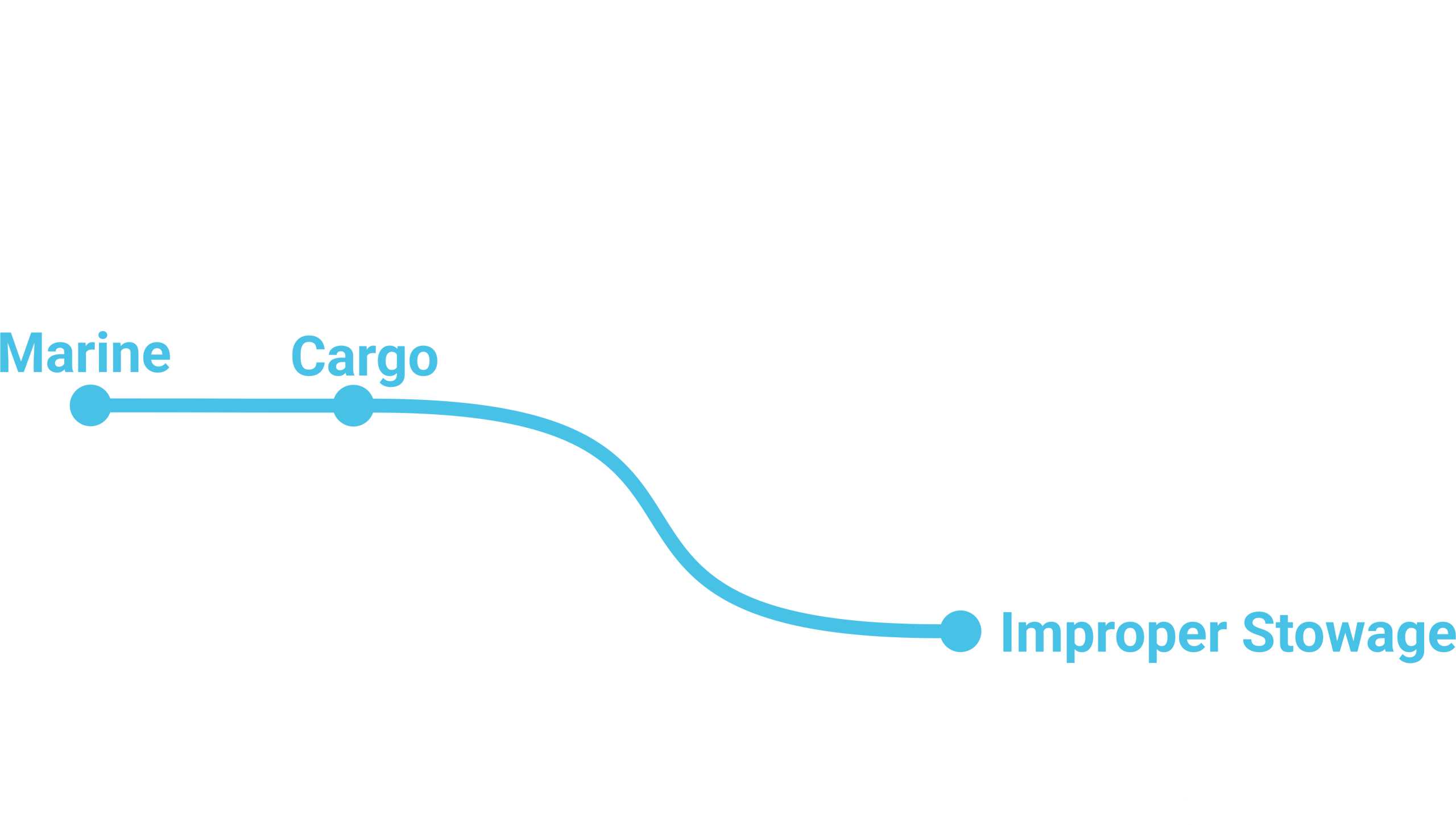

Notification to insight — in under 5 minutes

Client submits claim

(via portal or API)

Sofix reads & triages FNOL using AI

Automatic policy matching and SLA-based escalation

Claim created and routed in real-time

Analytics dashboard updates instantly

Why it matters

Challenges in London market claims

- Manual data intake

- Delayed triage and coverage checks

- High operational costs

- Fragmented claims data

- Client dissatisfaction

Sofix solves this

- Real-time automation

- Intelligent AI routing

- Configurable compliance

- Built-in SLA monitoring

- Human-in-the-loop quality

Key offerings

Claims automation

AI-powered Electronic First Notification of Loss reduces intake from days to less than 5 minutes.

Claims analytics

Cause code intelligence to refine underwriting and pricing. Proactive risk and fraud detection.

Why Sofix?

Engineered for the London market syndicates

- Deep London Market Expertise

- Blueprint Two alignment & Core Data Record support

- Secure cloud-native platform (GDPR & London Market compliant)

- Proven success in pilot deployments

See Sofix in action

Request a personalised walkthrough and discover how your team can move faster, with better claims intelligence.

Contact us

Get in touch with us today to explore how we can help streamline your processes, answer any questions, or provide the support you need. We’re here to assist you every step of the way.